The KYC principle: fraud prevention through identity verification

New requirements from the legislator or your fraud prevention department require you to perform an identity check on your new customers?

Identity verification of your customers is already part of your everyday business, but you want to make it more efficient?

In this blog post, we have compiled everything you need to know about identity verification as a building block of the Know-Your-Customer (KYC) principle and our associated product solution. If you have any further questions, please feel free to contact us!

What is meant by KYC?

A variety of criminal activities, including money laundering, terrorist financing, and insurance fraud go hand in hand with identity fraud. The economic damage caused by money laundering alone amounts to several billion dollars worldwide every year.

As a result, the financial industry has been subject to extensive due diligence requirements when it comes to managing the identities of its customers. Let's take a look at Europe: Here, the EU's 4th and 5th Anti Money Laundering Directives (AMLD) stipulate that banks must establish and verify the identity of their new customers.

The Customer Identification Program (CIP) is the U.S. counterpart to the AMLD. As part of the USA Patriot Act, it requires banks to verify the identity of their customers before they can open an account, for example.

However, the resulting principle of knowing one's customer (to Know Your Customer) is not only important in the financial industry. Although it is mandatory for the financial industry to check the identity of its customers, the KYC principle has long been standard practice in other industries as well, in order to prevent economic damage to the company. For example, the rental of cars or other high-value goods is often preceded by a check of the customer's identity.

What does a KYC process look like?

The scope of a complete KYC process varies by industry. However, it is true across all industries that identity verification of customers in the onboarding process is an important step in preventing money laundering and fraud.

Regardless of whether identity verification happens due to the legal obligation to do so or out of corporate interest, it always requires the presentation and verification of an identification document in line with the KYC principle. The verification can be carried out both in person and with the aid of video identification procedures.

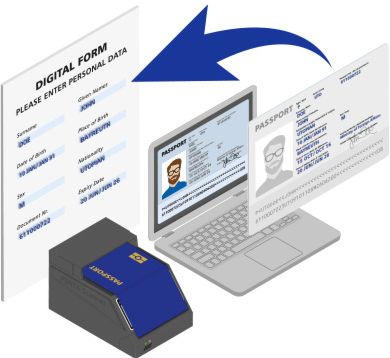

In a first step, the customer's personal data from the ID card is checked and, if necessary, automatically transferred to internal documents such as contract templates. The data that needs to be captured varies from case to case and is also decided on the basis of the risk associated with the desired transaction. Relevant data usually includes surname, first name, address data and date of birth.

In a second step, the identity document presented must be checked for validity on the one hand and for authenticity on the other. To ensure the authenticity of a document, various security features can be checked: These include holograms, laser tilt images and other printing features that are typical of ID documents. Are the checksums, which can be determined by certain professional calculations, correct? Does the information in the Machine Readable Zone (MRZ) and the Visual Zone (VIZ) match?

In accordance with the legal framework, a third step may also be taken at the end of a KYC process: logging the identity check that has been performed in order to be able to prove that the legal requirements have been met in the event of suspicion.

How do DESKO products support in the KYC process?

The requirements for a complete KYC process are extensive. Our product solution for efficient and smooth identity verification as part of KYC measures consists of a combination of security technology and software.

The ID scanners we have developed capture the data from the documents presented and, thanks to their technical features such as UV light, enable the document to be authenticated on the basis of its security features. Subsequently, the associated software application indicates within seconds whether it was able to detect any anomalies in the document and provides a verification report.

What advantages does the DESKO solution offer for your workflow?

1. Speed up your work processes: Data capture and security verification run simultaneously, onboarding your new customers is made easier.

2. More security: The naked eye is not enough to distinguish a genuine document from a high-quality forgery.

3. Integration into your system: We integrate our solution into your existing technical infrastructure.

4. Regular updates: We provide you with software updates on a regular basis, as both identity documents and the methods used by identity fraudsters are constantly evolving.

More on the topic